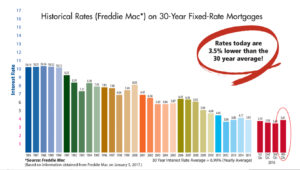

While the mainstream media is ‘touting’ a problem with rates, that is not so. Here is a visual look at interest rates for the past 30 years. It is still ‘free money’ in my opinion. I purchased my first house in 1981 (yikes, seems like yesterday) and the rate was a 18%. I was lucky to get a 13.5% ARM for 5 years. ARM = adjustable rate mortgage which allows for lower rates over a shorter period of time. My ARM was 5 years and then I refinanced. Note, the chart starts in 1986 and rates had fallen to the mid 10% range. Guess what? Houses were still selling and people were still moving, but you purchased “less house”. If you are thinking ahead and planning for your future you should be buying.

For example:

If your interest rate is 5 percent on $100,000, after plugging the numbers into the equation, you calculate your monthly payment to be $536.82. If your interest rate is .25 percent higher, at 5.25%, your monthly payment is 552.20, a difference of about $15 per month. If your loan is for $200,000 with a 15-year loan at 5 percent, your monthly payment is $1,581.59 and at 5.25% your monthly payment is $1,607.76. The .25 percent difference adds an extra $26 per month. And this is at 5% and 15 year loans.

Even less on 30 year loan and we are still around 4%! You and I know you are spending more at Starbucks on a weekly basis.

In 2017 buy a home. Lock in your rate. Lock in your monthly budget. Lock in a new lifestyle.